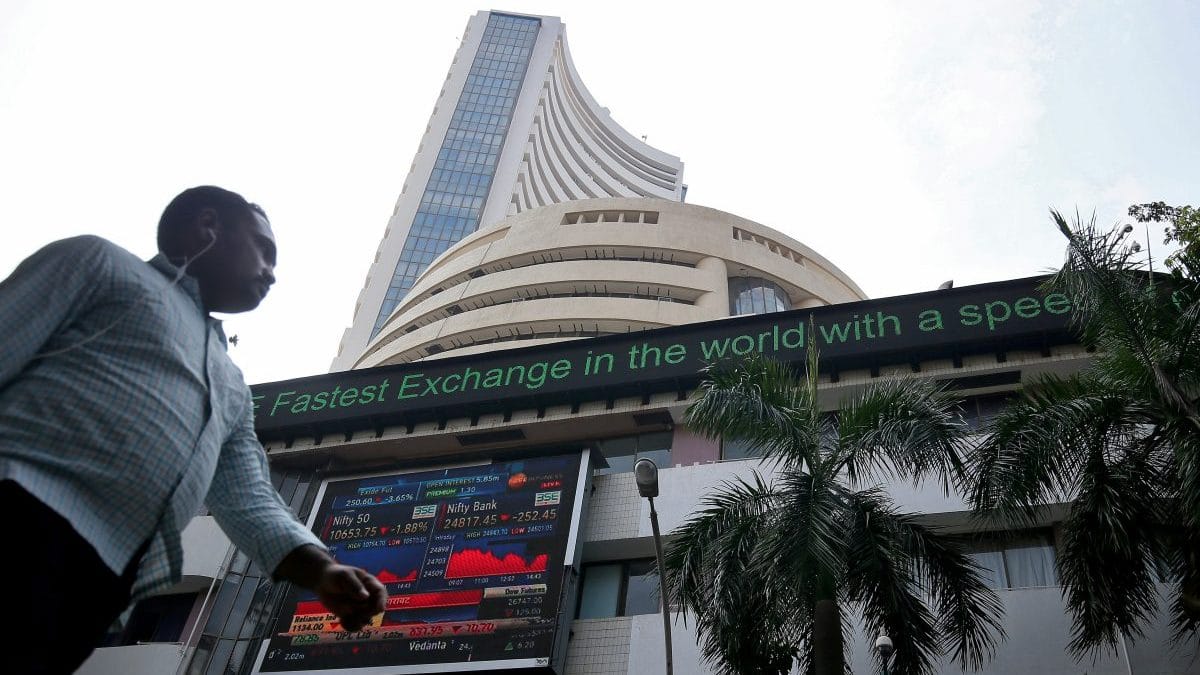

Nifty Outlook: Support placed at 19,300; Aarti Drugs, Welspun among stocks to buy

By Nagaraj Shetti

After showing a sustainable up move with volatility on Tuesday, Nifty continued with choppymovement on Wednesday and slipped into decline by 55 points. Nifty opened with a positivenote, and started to show weakness from the day’s high in the early part of the session. Minor intraday upside recoveries in between have been used as sell on rise opportunity and Nifty closed near the lows.

Positive chart pattern like higher tops and bottoms is intact as per daily time frame chart andpresent weakness could be in line with new higher bottom formation at the highs. On a movebelow 19,300, the market is likely to find another important support of 19,100-19,000 levels. Fresh buying could only emerge on a decisive move above 19,550 levels.

Stock Picks

Buy Aarti Drugs Ltd- (CMP: Rs 490.50)

After shifting into a broader range bound movement in the last few weeks, the stock price(AARTIDRUGS) has shifted into a sustainable upside bounce so far this week. The stock pricehas witnessed an upside breakout of down sloping resistance line at Rs 485 levels and iscurrently trading higher. Volume and momentum oscillators are showing positive indications.Buying can be initiated in AARTIDRUGS at CMP (Rs 490.50), add more on dips down to Rs 470,wait for the upside targets of Rs 535 and Rs 575 in the next 3-5 weeks. Place a stoploss of Rs 455.

Buy Welspun India Ltd – (CMP: Rs 98.70)

The downward correction of June month seems to have completed in the stock price WELSPUNIND, as it witnessed a sharp upside bounce in the last couple of weeks. The stock priceis currently placed at the edge of breaking above the bullish flag pattern at Rs 100 levels, as per weekly time frame chart. Volume has started to rise and weekly RSI has turned up fromnear 65 levels.Buying can be initiated in WELSPUNIND at CMP (98.70), add more on dips down to Rs 95, waitfor the upside targets of Rs 107 and Rs 115 in the next 3-5 weeks. Place a stoploss of Rs 92.

(Nagaraj Shetti, Technical Research Analyst, HDFC securities. Views expressed are the author’s own. Please consult your financial advisor before investing.)

1/9

1/9  2/9

2/9  3/9

3/9  4/9

4/9  5/9

5/9  6/9

6/9  7/9

7/9  8/9

8/9  9/9

9/9