The India Meteorological Department ( IMD) says that Cyclone Biparjoy is expected to make a landfall on Gujarat’s Saurashtra and Kutch regions and adjoining Pakistan coasts on June 15 between 4 PM to 8 PM. In the view of the very severe cyclonic storm, the weather department has sounded a Red Alert as for the Saurashtra and Kutch coasts. Bracing for the cyclone, several NDRF and SDRF teams have been deployed, while residents of coastal areas were being shifted to shelters in parts of Gujarat. Meanwhile, PM Narendra Modi, Union Home Minister Amit Shah and Union Health Minister Mansukh Mandaviya reviewed preparedness for cyclonic storm Biparjoy. Here we bring to you a glimpse of these coastal areas where NDRF, SDRF and the Indian Army preparing to provide succour to the locals post the landfall of the fierce cyclone Biparjoy.

1/9

1/9

Indian Army troops reach the coastal line of Gujarat as it prepares for landfall of cyclone Biparjoy in the state. (Photo Credits: Indian Army)

2/9

2/9

The flood relief columns have been rehearsed and kept ready at Bhuj, Jamnagar, Gandhidham, Dharangdhra, Vadodara and Gandhinagar as well as at forward locations at Naliya, Dwarka and Amreli. The resources have also been made available from neighbouring Rajasthan as well to ensure minimisation of any loss due to the gusty winds and heavy rainfall. (Photo Credits: Indian Army)

3/9

3/9

The Indian Army prepared itself to provide succour to the locals post the landfall of the fierce cyclone Biparjoy in Gujarat. The Army authorities have also jointly planned the relief operations with civil administration as well as NDRF. (Photo Credits: Indian Army)

4/9

4/9

High waves crash against shops near the shore ahead of the landfall of Cyclone Biparjoy, in Mumbai. According to the meteorologists, the wind speed can go upto 125-135 km (78-84 miles) per hour. (Photo Credits: PTI)

5/9

5/9

People evacuated from Kandla port, in preparation of Cyclone Biparjoy, rest at a shelter in Gandhidham, India. Authorities on Monday halted fishing activities, deployed rescue personnel and announced evacuation plans for those at risk. (Photo Credits: AP)

6/9

6/9

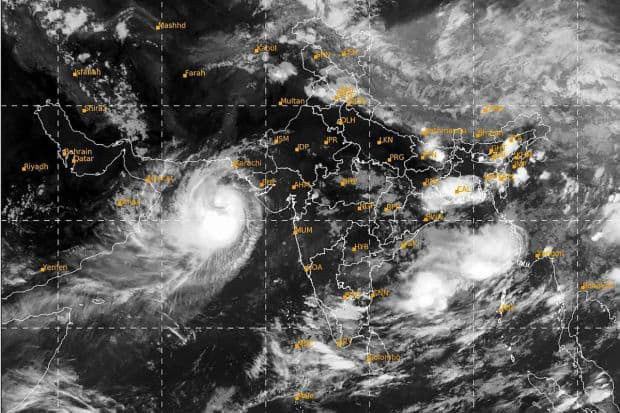

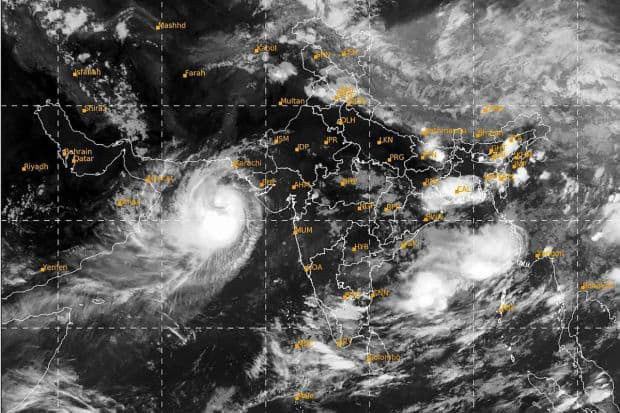

Satellite image taken between 08:30 pm to 08:56 pm IST shows the location of Cyclone Biparjoy in the Arabian Sea on Tuesday. (Photo Credits: PTI)

7/9

7/9

In a dramatic rescue operation, the Indian Coast Guard has succeeded in evacuating 50 personnel from an oil rig located 40 km off the coast of Gujarat as the nation prepares for the impact of cyclonic storm. (Photo Credits: PTI)

8/9

8/9

The government has shifted around 4,500 people from coastal areas to various shelter homes ahead of cyclone Biparjoy, which is expected to cause extensive damage when it makes landfall near Jakhau port in Kutch district on Thursday. (Photo Credits: PTI)

9/9

9/9

Union Minister Mansukh Mandaviya visits Bhuj Military Station to assess army’s readiness for cyclone Biparjoy, in Bhuj on Tuesday to review preparedness for cyclonic storm Biparjoy. (Photo Credits: PTI)

1/9

1/9  2/9

2/9  3/9

3/9  4/9

4/9  5/9

5/9  6/9

6/9  7/9

7/9  8/9

8/9  9/9

9/9